SWIFT GPI v2.0

SWIFT gpi

Cross border payments slowness and lack of transparency is a major focal point of complaints by both corporate and retail clients. While tracking technology has infiltrated all aspects of daily client oriented tasks, it was still non-existent regarding financial payments. Payments nowadays can take days if not weeks with both the sender and beneficiary in total darkness. This lack of end-to-end information involving cross border payments will be a thing of the past thanks to SWIFT gpi. Based on industry demand SWIFT introduced the Global Payment Innovation (GPI) cloud based service which is an industry wide collaborative program aiming at improving cross border payments end-to-end tracking. SWIFT gpi services are based on multilateral service level agreement operating under strict common business rules. Benefits of SWIFT gpi:

Global Payment Innovation platform

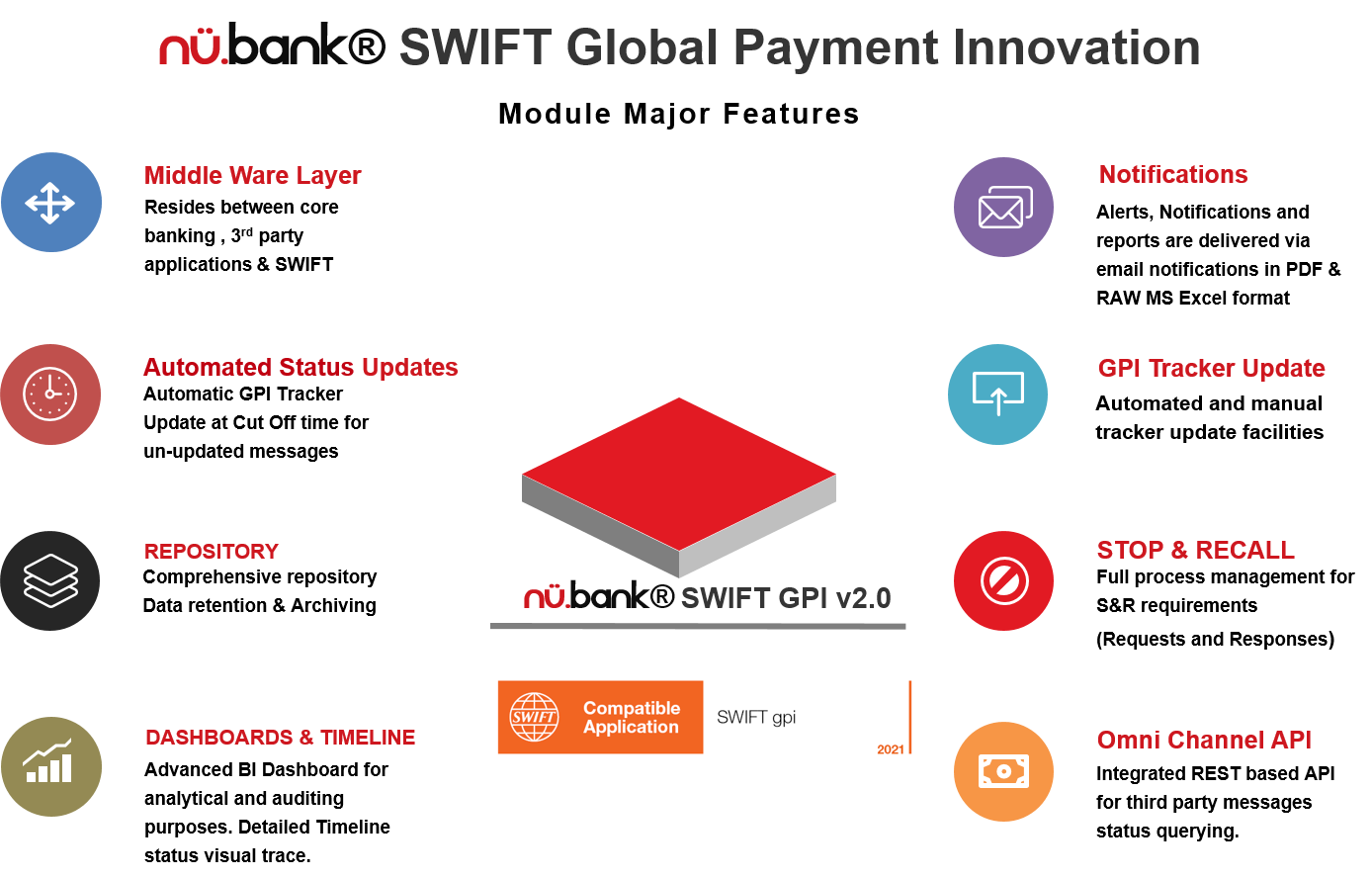

nü.bank® Global Payment Innovation platform is designed in full accordance with SWIFT gpi SR2021 customer credit transfer rulebook. currently supported gpi services:

- gCCT – Customer Credit Transfer

- gCOV – Cover Payment Transfer

- gSRP – Stop & Recall Transfer messages

- gFIT – Financial Institutions Credit Transfer

Currently SWIFT SR2021 covers for the following messages:

- MT 103, MT103 STP, MT103 REMIT and MT202(gFIT)

- MT 202/205 COV

- MT199, MT 299, MT 192, MT196

nü.bank® Global Payment Innovation platform is an autonomous JAVA based platform residing on a dedicated server running 24/7/365 acting as a middleware between core banking and third party application and the SWIFT Tracker.

For additional information related to SWIFT Certified Applications kindly press here.

nü.bank® Global Payment Innovation platform offers financial institutions three options for SWIFT gpi Compliance:

- Batch mode integration for small sized FIs for “Universal Payments Confirmation” compliance.

- Automated mode integration for small and medium sized FIs for “Universal Payments Confirmation”.

- Automated mode integration for full SWIFT gpi payments compliances (Incoming/Outgoing).

nü.bank® Global Payment Innovation platform is MX ready (full SWIFT gpi version only )